Questions and Answers on Trade and Tariffs

What is a tariff?

A tariff is a tax on foreign goods paid by American consumers.

Can tariffs be avoided by buying American?

No, tariffs cannot be avoided by buying American. The tariff on foreign goods purchased by Americans increases the demand for domestic goods. For domestic manufacturers to meet this demand, they must expand production. This requires pulling resources (labor, capital, land, machines, and materials) from other industries, driving prices up, until the price of domestic goods is the same as that of foreign goods with the tariff.

Tariffs tend to fall regressively on the poor. As the price increases, the relatively poor must either 1) pay the higher price for the good, which puts more strain on the budgets of the poor than the rich, or 2) forgo purchasing the product.

What are the economic effects of a tariff?

Tariffs have far-reaching economic consequences that outweigh their intended benefits. Here are the three primary effects:

1. Distortion of Resource Allocation

Tariffs protect specific industries by shielding them from foreign competition, but this comes at the expense of more efficient sectors. By artificially propping up less competitive firms, tariffs discourage innovation, cost-cutting, and hard work, undermining market incentives. Resources are diverted from industries where the U.S. excels, reducing overall economic efficiency. For example, the 2018 U.S. steel tariffs increased domestic steel prices, benefiting producers but harming manufacturers like automakers and farming equipment manufacturers, who faced higher costs.

2. Increased Costs of Doing Business

Approximately 60% of imports are intermediate goods, inputs like raw materials and compounds used by American firms. Tariffs raise the cost of these inputs, forcing businesses to cut production, lay off workers, or pass higher prices on to consumers. This ripple effect reduces U.S. competitiveness in global markets, as firms selling abroad struggle against cheaper foreign competitors.

3. Lower Real Wages and Living Standards

Higher prices from tariffs erode consumers’ purchasing power, effectively lowering real wages. Workers can buy less with their income, reducing their standard of living. The 2018 tariff on washing machines had a measurable increase in prices for American households. These costs disproportionately affect lower-income families.

Does international trade harm U.S. producers?

International trade, like any market-driven process, creates winners and losers, but labeling it as harmful to American producers simplifies the issue. Trade generates both benefits and costs, but protectionism inflicts far greater economic damage. Economists overwhelmingly oppose protectionism because its costs dwarf any benefits. Here are some of the expected costs of tariffs:

1. Job Loss in Trade Industries

If the U.S. restricts imports, industries like shipping, trucking, and port operations lose business. This also affects workers in logistics, international purchasers, translators, and supply chain management.

2. Higher Costs for Domestic Producers

Protectionism raises production costs since approximately 60% of imports are inputs, such as raw materials or compounds, for U.S. businesses. This reduces sales, profits, and employment in these sectors.

3. Fewer Exports/Decreased Investment

Protectionism reduces foreign access to U.S. dollars, limiting their ability to buy American exports or invest in the U.S. economy. A stronger U.S. dollar, driven by reduced imports, further prices U.S. goods out of global markets.

International trade creates significant economic benefits as well:

1. Job Creation

Trade supports approximately 40 million U.S. jobs, including dockworkers, truckers, and manufacturers producing for export or using imported inputs.

2. Consumer Benefits

Trade lowers prices and increases variety, boosting purchasing power.

We also need to put trade-related job loss into perspective. Trade can displace some U.S. workers, particularly in low-value areas such as textiles or furniture. However, these losses are a small fraction of the 21 million jobs created and lost annually in the U.S. economy. The primary drivers of job churn are:

1. Automation

Technologies like robotics and AI have replaced repetitive, low-skilled jobs, freeing workers for higher-paying, creative roles. For example, mechanized farming, fertilizer, and drip irrigation reduced agricultural employment from 40% of the workforce in 1900 to 2% today, enabling the growth in tech and services and expanding occupational choice.

2. Technological Bundling

Smartphones have displaced standalone devices like calculators, cameras, and MP3 players, consolidating industries and redirecting labor to new sectors. This innovation drives long-term economic growth and frees up labor to produce other valuable goods and services.

3. Changing Consumer Preferences

Shifts in demand, such as the rise of weight-loss drugs like Ozempic, disrupt industries like fitness centers or health food. Blocking these shifts would force firms to produce unwanted goods, lowering wages and efficiency.

4. Competition Among the States

States such as Ohio and Michigan lose manufacturing jobs not to China but to states like Texas and Tennessee, which offer lower taxes and fewer regulations. Protectionism only serves to distract us from addressing domestic policy failures that drive these losses.

Defining trade as harmful because it disrupts certain producers is misleading because it applies to all social decision-making. For instance, choosing one spouse “harms” other suitors, just as opening a factory in one city “harms” another. This is ubiquitous in any system, whether capitalism or socialism. Banning trade to protect specific producers is akin to banning Airbnb to shield hotels: it stifles innovation and consumer choice. The benefits of international trade, including lower prices, more jobs, and greater efficiency, far outweigh its costs, which are better addressed through retraining programs than protectionism.

Does international trade suppress the wages of workers?

International trade does not inherently suppress workers’ wages. Instead, it often raises real wages by boosting productivity and economic efficiency. The key to raising living standards for all Americans lies in increasing productivity, our ability to produce more goods and services with fewer resources. Trade facilitates this by fostering competition, innovation, and access to affordable inputs. Protectionism fails to deliver higher wages because:

1. Protectionism Redistributes Wealth (Regressively)

Protectionism temporarily boosts wages in propped-up industries by limiting foreign competition. However, this comes at a steep cost to other Americans. Higher input costs and consumer prices reduce purchasing power, disproportionately harming lower-income households. This redistributes wealth from consumers and efficient industries to less competitive ones.

2. Protectionism Undermines Long-Term Efficiency

By shielding propped-up industries from competition, protectionism undermines the market signals that drive hard work, innovation, and cost-cutting. This central-planning approach reduces overall economic efficiency, slowing productivity growth, which is the foundation of real wages.

The primary drive for higher wages and improved living standards is economic freedom, which includes free trade. Over 1,000 peer-reviewed studies show that countries embracing free markets and trade liberalization experience higher wages, longer life expectancy, and greater life satisfaction. Trade exposes firms to global competition, forcing them to innovate and improve efficiency, which boosts productivity and real wages. Global poverty has plummeted, largely due to countries like China and India adopting more economic freedom.

What are trade deficits? Are they a concern?

A bilateral trade deficit is an accounting identity, neither inherently good nor bad, and is not economically meaningful. When the U.S. imports more from a specific country than it exports to the U.S., it is as irrelevant as an individual having a “trade deficit” with Costco because Costco sells more to the individual than the individual buys from Costco. Trade is not a zero-sum game. It is mutually beneficial.

The U.S. has run a trade deficit every year since 1976. Far from signaling weakness, this reflects the U.S.’s attractiveness as a global investment hub. Foreigners prefer investing in the U.S., driving a capital surplus that is balanced by our trade deficit. The U.S. attracts foreign capital due to its economic freedom, including low taxes, stable currency, the rule of law, sensible regulations, and open trade policies. This inflow of funds has built industries and helps finance the national debt at lower interest rates, benefiting taxpayers. Also, since approximately 60% of our imports are inputs used by domestic producers. The investment and the availability of affordable inputs have driven a 177% increase in inflation-adjusted manufacturing output since 1975, the last year of a trade surplus.

Does international trade cause job loss?

Our unemployment rate is 4.1 percent. This is low historically and relative to other nations. We currently have more job openings than people looking for work.

We could further improve these outcomes by decreasing regulations, such as occupational licensing and the minimum wage, and eradicating the abuse of disability payments. But this is hardly an indictment of international trade.

Protectionism, by expanding production in propped-up inefficient industries, would necessarily have to draw labor, capital, and materials from other areas of production, reducing American productivity compared to other nations.

Goldman Sachs estimates that just the 10% tariff from Trump will destroy 5 American jobs for every job they create, even assuming no recession and no retaliation.

America does not manufacture anything anymore.

Manufacturing is thriving in the U.S., with value added of manufacturing of $2.5 trillion, higher than it has ever been. This is 12% of U.S. GDP.

People come from all around the world to start companies here. We have the biggest companies in the world. And we attract investment from all over the world. This fuels innovation, high-wage jobs, and advanced manufacturing.

According to the Office of the United States Trade Representative, America was the world’s second-biggest goods exporter, exporting turbines, cars, aerospace products, pharmaceuticals, and soybeans, and the biggest services exporter in 2022.

The number of Americans working in manufacturing has been in a several-decade decline, not caused by NAFTA or China joining the WTO, but because of automation. Similar employment declines in manufacturing have occurred in other countries, freeing up labor for higher-skilled jobs. jobs. Most manufacturing job losses have been in low-end apparel, textiles, and furniture. Manufacturing output of high-end goods, such as computers, electronics, and cars, has surged!

Is America being ripped off?

We are, by far, the wealthiest large country in the world. Our annual GDP is 2.7.4 trillion, much larger than other countries, like China ($18.3 trillion) or Japan ($4.2 trillion). It’s hard to see how foreigners in international trade are ripping us off. International trade has fueled this growth.

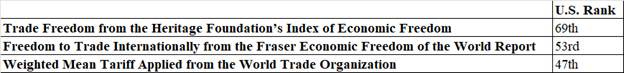

The United States is currently one of the worst offenders among developed nations in placing discriminatory tariffs and non-tariff barriers on our trading partners.

Trump’s tariffs, even with the pause, make us one of the most tariffed countries in the world, with an average U.S. tariff rate of 25%, more than any other industrialized nation.

What are the unique effects of Trump’s tariffs?

Capital Flight: To reduce trade deficits, countries will 1) reduce their investments in the U.S. and 2) encourage more investment in their countries

Uncertainty: The Economic Policy Uncertainty Index shows that we are at an all-time high. More uncertainty than the peak of COVID!

There is no example in the history of advanced economies implementing large across-the-board tariffs similar to this and achieving the aims of higher economic growth or domestic investment.

What about the goal of tariff reciprocity?

Given that a tariff is a tax paid by Americans, our goal should be to make that tax as efficient and predictable as possible for our own circumstances. By allowing other countries to determine our tariffs, we lose the option to tailor these taxes and keep them stable for consumers and U.S. businesses.

The high costs of computing and constantly monitoring these tariffs, considering all the forms of non-tariff barriers, would be extremely high. We would have to have country-level experts for every country.

If we wanted reciprocity, we should begin by lowering our tariffs, since we have higher tariffs than most of our major trading partners.

What about the goal of using tariffs to negotiate free trade deals?

Reneging on Previous Agreements Reduces Negotiation Credibility

It is hard to credibly negotiate when we are reneging on previous agreements, including the trade deal Trump negotiated with Canada and Mexico in the first term, which he called “the fairest, most balanced, and beneficial trade agreement we have ever signed into law. It’s the best agreement we’ve ever made.”

Our Protectionism is Worse Than Most Major Trading Partners

Our trade protectionism is higher than most of our trading partners, so it would have made a lot more sense, and caused much less damage, to simply drop our rates and encourage other countries to do the same.

The Structure of Trump’s Liberation Day Tariffs are Nonsensical

Trump placed tariffs on all countries, whether they had a trade deficit or not with the United States. Australia has essentially no tariffs on the US and a trade surplus with the US, yet they have a 10% tariff. Negotiation with 90 countries, monitoring, and updating would be nearly impossible. He should have selected a few major trading partners if negotiation was the goal.

The structure of the Liberation Day tariffs is not designed to incentivize countries to reduce their tariffs. Vietnam offered to drop its tariffs to zero, and the Trump administration said it wasn’t enough.

Long-term Consequences of Promoting Protectionist Views

Trump has said tariffs are one of the most beautiful words and called himself a “tariff man.” In this, and many other examples, he has encouraged economic illiteracy on trade among his supporters. His administration has said these are not a negotiation tactic. One can only surmise that Trump does not believe in free trade.

Even if this is a negotiating tactic, the long-term consequences of encouraging trade skepticism will cause far more long-term damage:

The Costs of Uncertainty

The uncertainty of delayed business investment is causing immense damage to our economy. Long-term uncertainty can reduce wages and employment.

Reputational Effects and Voluntary Consumer Boycotts

Our global reputation is taking a hit even among long-standing trade partners.

Trade is Between People, Not Governments

Governments ink negotiation deals, but trade is between people. This has two implications:

1. Most people in developing countries cannot afford our high-end exports. India’s GDP per capita is $2,500. China’s is $12,500. Mexico’s is $13,700. These countries cannot afford our automobiles, advanced electronics, or medical equipment.

2. Even if a trade agreement is inked, it is unclear that consumer boycotts against the U.S. will end. Examples include Canadian merchants ripping U.S. products off their shelves and the Danes turning to the domestically manufactured Jolly Cola.

What are Trump’s Justifications for Tariffs?

Trump’s administration has offered three justifications for tariffs. These justifications are economically flawed and mutually incompatible, meaning that pursuing one undermines the others.

1. Protecting Domestic Industry

Tariffs cannot raise revenue because the whole point is to strongly encourage Americans not to buy foreign goods to protect American manufacturers.

2. Raising Revenue

Tariffs cannot protect industries because, if revenue is the goal, tariffs will be set to encourage Americans to continue buying foreign goods.

3. Negotiation

Tariffs will not raise revenue or protect industry because they are only used to remove them.

China

China has twice the manufacturing of the United States, but it has 4 times the U.S. population. They tend to have a lot of low-value manufacturing and jobs that are not sensible in the United States. U.S. GDP per capita is $82,700 compared to China’s $12,500.

Oftentimes, we do not consider the incentives created by our interventions in complex economic systems. Trump’s tariffs, which exempt high-value goods coming to the U.S., may encourage China to specialize in high-value manufacturing, which will more directly compete against the U.S. China would also be incentivized to forge new alliances with neighboring countries, which could undermine national security.

Trump’s tariffs cover all our imports. China only exports 13.7% of its exports to the U.S., so the relative harm from tariffs will be higher in the U.S. than in China.

1. The U.S.’s largest exports to China are soybeans, aircraft, and oil. They will buy them from Brazil, Airbus, and Russia.

2. China’s largest exports to the U.S. are electronics. They have already been exempted due to the harm they were going to cause.

IP: Dan Griswold and Don Boudreaux have a white paper on this. The problem is real but manageable. China has been moving in the right direction in better respecting IP law. Ways to better manage IP concerns:

1. Joint cases in the WTO to pressure China. China has resolved nearly every WTO claim.

2. Rejoin the Trans-Pacific Partnership, which encourages tariff elimination and IP rights enforcement.

3. Targeted legal action against the specific Chinese parties responsible for IP rights violations.

Buying American

Buying American is not a meaningful concept in a globalized world. Even products that are assembled here, such as Jeeps, have components from all over the world. They can even have fewer American components than foreign cars, like Hyundai, manufactured in the United States. Even though it is a foreign manufacturer, the iPhone creates tons of jobs here in America.

When you buy foreign goods, you create jobs here in the United States by providing U.S. dollars to the world market to buy American goods and services and to invest in America.

What about the threat of dumping?

Most accusations of dumping are simply a foreign firm selling at a lower price because they are more efficient. Dumping is only possible if employed by a more inefficient firm, which, by definition, means that the dumping firm loses far more than the domestic firm by lowering its price. It is a losing strategy, which is why it is not taught in MBA programs.

The conditions for dumping to operate are extremely unrealistic. They assume:

1. That a foreign company, with no competitors from their own country, has enough cash to lose to drive out every producer in the United States.

2. The only thing American consumers care about when buying a product is price.

3. There are no other foreign producers of that good that will sell to Americans.

4. The factories that went bankrupt in the US will not be purchased by investors and restarted when the foreign firm raises its prices.

Example: Obama’s tariffs cost about $1.2 million per job saved in today’s money.

What about foreign subsidies?

By subsidizing some industries, they must be taxing others, so they are helping some industries while hurting others. If we put tariffs on goods subsidized by foreign governments, we should lower tariffs on goods not subsidized. Protectionism will only pile another layer of harm on top of it.

What if foreigners buy U.S. Debt?

This is an argument against U.S. deficit spending, not foreign trade.

Also, the worst-case scenario is that foreigners purchase U.S. debt and then have a fire sale

1. The U.S. could then buy back its own debt at discounted prices

2. Foreign countries would suffer major financial losses

This concern is also unrealistic

3. The U.S. economy is so massive compared to any other government that foreigners would have to accumulate massive amounts of U.S. debt, which would require confiscatory taxation and a crowding out of private sector investment, with harsh economic consequences.

4. Meanwhile, U.S. Economic growth will increase due to this foreign investment

Foreign purchases of US debt will, all else equal, lower the interest rate and reduce the crowding out of private investment.

Is it a concern that foreigners invest in U.S. companies?

Foreign investment in the U.S. has tons of benefits:

1. All profits made by foreign-owned companies in the U.S. are in American dollars

2. Foreigners can purchase American goods & services or invest in American stocks, bonds, or real estate

3. The more bidders, despite their passport identification, the higher the price American assets will receive

4. Foreign investors provide a wider range of entrepreneurial ideas and managerial talent

5. Worldwide economies of scale

6. Disruption of domestic rent-seeking and cartelization

7. Makes us more diversified and thus less prone to financial contagion

Is there a disappearing middle class?

No. The American middle class is moving up to higher income brackets: https://www.aei.org/carpe-diem/yes-the-middle-class-has-been-disappearing-but-they-havent-fallen-into-the-lower-class-theyve-risen-into-the-upper-class/

Are wages stagnating?

Not if you look at total compensation adjusted for inflation with the PCE index, a better inflation measure: https://www.cnbc.com/2014/01/29/-wage-stagnationcommentary.html

America today

Americans are doing extremely well:

· We are 4.2% of the population but produce 26% of the world's GDP.

· U.S. Median income is nearly 9x the global average

· The unemployment rate is 4%, below the long-term average.

· The number of unemployed is 7 mil, below job openings at 7.5 mil.

· Median earnings of an American without a high school degree is over $38,000.

· U.S. poverty rate is about one-fortieth of the global rate.

· Minimum wage workers are 1% of hourly paid workers, below the age of 20, disability workers, or tip workers. This leaves only .2% of hourly paid workers earning the minimum wage. 60% of those .2% are under 19 and 82% are part-time workers.

We are different, but this isn’t by chance, it is because of our economic freedom. But trade restrictions are undermining that freedom.