Billionaire Wealth Concentration

United States vs. The Nordics

There has been increasing concern about the wealth concentration of billionaires in the United States. This concentration of wealth can translate into economic power or influence over the economy which can be leveraged for political power. The Nordic model is often held up as a counterexample where high marginal tax rates and generous welfare programs prevent the concentration of wealth experienced in the United States.

We can examine this using data. I pulled data from the Forbes Billionaire list, the World Bank, and the Credit Suisse Global Wealth Databook. The earliest year for which I had all the necessary data was 2019.

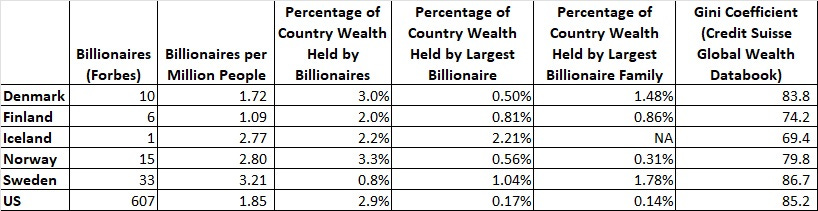

After several hours of data collection (it was intensive), I produced the following table:

Compared to the Nordic countries, the United States has the lowest, and substantially so, percentage of country wealth held by the largest billionaire and by the largest billionaire family. While we would need a lot more data to draw serious policy conclusions, it does suggest that there is something in the United States model, as compared to the Nordic model, that encourages a higher dispersion of wealth. My intuition is that high marginal tax rates in the Nordic countries disincentivize and prevent the accumulation of wealth, leading to a concentration of old wealth, though this would require much more extensive data collection and analysis to test.

But, the data does suggest that wealth concentration, and thus the influence of billionaires on the economy and in politics, is more of a problem in Nordic countries.